- Home

- Hospital Indemnity Sales Tools

Getting Started with Hospital Indemnity

Hospital Indemnity Insurance (HIP) is an indemnity policy designed for when a client enters the hospital to help offset or eliminate any hospitalization co-payment or costs. Benefits are paid directly to the policy holder, most plans have simplified underwriting and they can be paired with other insurance plans including:

Medicare Advantage

Medicare Supplement (High Deductible F is ideal)

Group Coverage

Stand Alone Plan

Client Facing Customizable HIP Flyer – Simply enter your information for an instant marketing piece.

Why Offer Hospital Indemnity Plans and How

Hospital Indemnity Plan Introduction Letter to Clients

Hospital Indemnity Plan 3 Options Client Worksheet

SMS Agent Marketing Portfolio Order Form

Hospital Indemnity & Cancer Plan Sales Technique Cheat Sheet

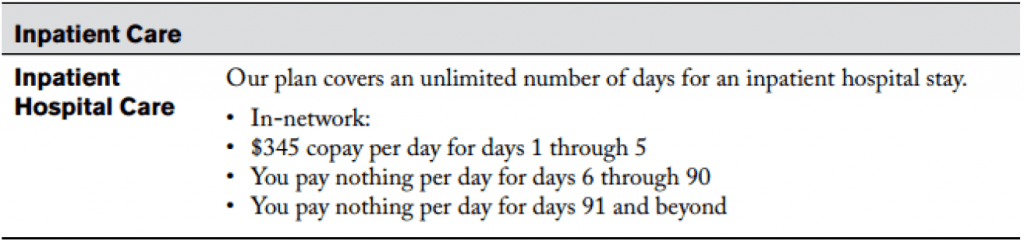

Below is an excerpt from a Medicare Advantage Summary of Benefits:

As you can see from the example summary of benefits, the in-network hospital copayment is $345 per day, days 1-5.

When explaining this to a client, use one of the following explanation statements to transition in to the product details.

When you are admitted to the hospital, your co-payments will be $345 per day, days 1-5. After day 6 you are covered 100%. We do have a hospital benefit available that can offset some or all the hospital co-payment. I will explain that benefit in greater detail at the end of this book. Okay?

—–OR——

I do have an optional hospital benefit that can be added that will send you a check for some or all of the hospital co-payment. I will tell you more after we work through this book. Okay?

Many HIP plans have additional riders you can add to the coverage. These will depend on the carrier.

- Ambulance Services

- Skilled Nursing

- Outpatient Services

- Cancer Lump Sum Benefit

Depending on your client’s needs and concerns, your plan structure may vary. One popular rider is the lump sum cancer benefit. This provides a lump sum of money, usually from $1,000 -$10,000, on the first diagnosis of certain cancers.

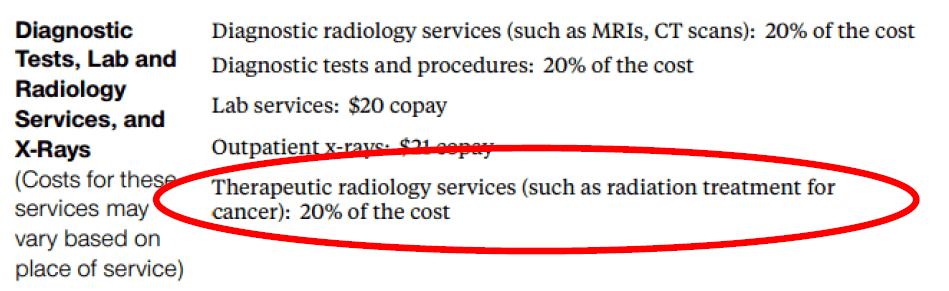

As you can see from the sample excerpt below, your client will owe 20% of all radiation treatments.

With that potential high out of pocket cost, a lump sum cancer rider can help offset or eliminate any cost, depending on the benefit and policy.

Transition Statement:

We can structure that hospital benefit I mentioned to have a lump sum benefit to be delivered to you to help pay for chemotherapy, doctor office visits, other therapies, travel if you want to get treatment out of town, hire a home health aide to assist you and your family during the chemo process, etc.

When you reach the end of the summary of benefits, you can offer 3 options for your clients to choose from:

- Medicare Advantage Plan with full co-payments

- Medicare Advantage Plan with the hospital benefit – This will offset the hospital co-payment should you be admitted to the hospital.

- Medicare Advantage Plan with the hospital benefit PLUS a cancer benefit – Along with the hospital benefit, you will receive a lump sum to help offset cancer treatments and other expenses that are not covered by Medicare such as travel, additional support, transportation, etc.

Let your client choose which option best fits their wants and needs. You can download our HIP Plan Comparison Worksheet here. It will let you fill in each ‘option’ as you present and then the client can keep the worksheet when you are done. That way if they choose the lowest option they will still have the information about the better coverage pricing should they choose to upgrade.

The Senior Marketing Specialists Quote Engine offers the ability to show HIP plans stand alone or side by side with our Fill The Gaps tool. The Fill the Gaps tool is a great way to compare current coverage with and without the added protection of a HIP and will even breakdown the premium of the HIP per benefit so the client can see the added value benefit by benefit.

Click here to learn more about our Quote Engine.

Need training on hospital indemnity, the products, and how to offer it to your clients? Check out the Hospital Indemnity Courses on SMS-University.

Need personalized marketing pieces?